April 11, 2024

Australia industrial policy spending

Labor in Australia is about to follow the USA in big spending on economic transition.

The announcement is to spend on expanding mineral extraction and processing to support inputs to new industries.

There is a “new and widespread willingness to make economic interventions on the basis of national interest and national sovereignty,” [Albanese] said.

Labor policy folks seem to be reading the tea leaves better than their counterparts here in Canada.

The "Future Made in Australia Act" is going to be similar in goal as the Inflation Reduction Act in the USA in subsidizing capital to invest in productive industry expansion.

We have to think differently about what Government can – and must – do to work alongside the private sector to grow the economy.

To boost productivity, improve competition and secure our future prosperity. Combining market tools, with government action - to create wealth and create opportunity.

We need to take a fresh look at how government can support small business and start-ups and service industries to diversify our economy and our trade. Not just playing to our traditional strengths with our traditional partners, but offering new products and services to new markets.

We need this change in thinking and approach, because the global economic circumstances are changing in ways far more profound than the consequences of the pandemic or conflict alone.

This decade marks a fundamental shift in the way nations are structuring their economies. A change every bit as significant as the industrial revolution or the information revolution – and more rapid and wide-ranging than both. (Albanese)

Will it work? Well, it might stop the continued erosion of manufacturing since the car companies left the country a decade ago.

Green(er), high-tech focused manufacturing could be somewhere that value added production is expanded. There is plenty of "friendshoring" benefits from the shift in Asia away from China and, like Canada, Australia has a population that is highly educated.

I think that the focus of Australia will be to compete with China for mid-stream critical mineral processing. It is the same area that Canada should be supporting, but the government has been unwilling to drive investment.

The Interventionist State must come back when it comes to industrial development because the free market is unable to make these investment.

The China hawks in the USA are all saying that China is "cheating" because it is out-competing Western capitalism by having a fully developed industrial strategy. As such, they call it "unfair" competition. The reality is that we have run out of road of driving economic growth through pretend profit subsidies on the financial side. If we want to build things in the West, we must stop complaining about Asia engaged in "planning" and do a little ourselves.

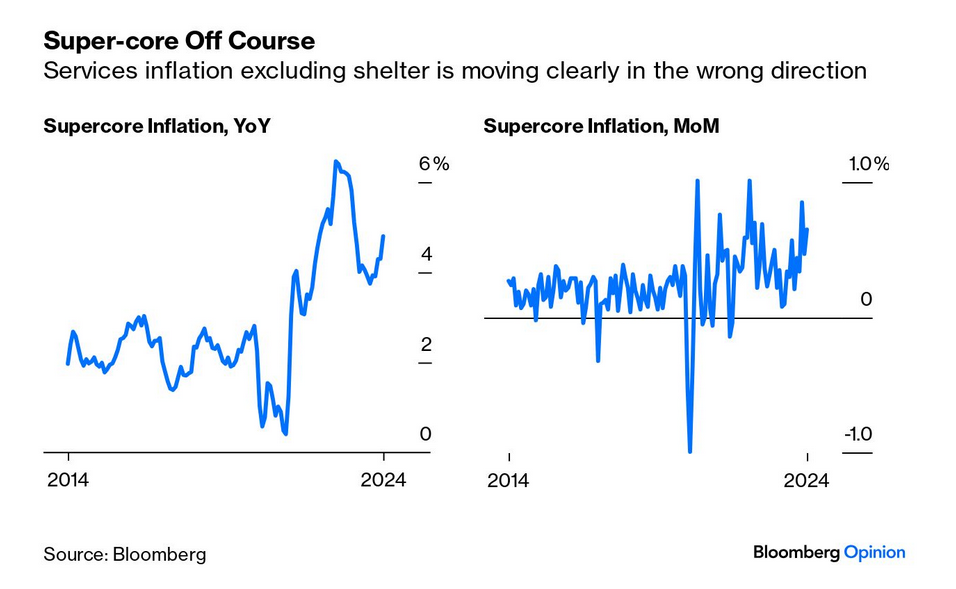

Inflation is blamed on wages again

Note: Canada's economy has diverged from the USA enough on CPI and growth that there is little reason to think that increased inflation in the USA should delay rate decreases of our central bank. Except that Canada's central bank is lead by people who do not want to decrease rates.

Apparently, this is all we need to blame workers for inflation:

- Services inflation is up.

- Services are labour intensive.

- Wage growth is above inflation.

Must be those pesky workers, right?

Well, labour markets are less tight now than they were when inflation was creeping up, we have already seen that the lower end of the wage grid is not doing so well, debt has risen again, and businesses who actually measure basic consumption have said working class people are not doing great. Also, we know that excess money that was printed went to subsidizing profits.

And, personal consumption expenditure inflation, which is what the Federal Reserve monitors is 1% below the headline inflation number.

So, working people are should take less of the blame now than even previously during high inflation growth.

The components of inflation growth point to health costs, mortgage price increases, insurance costs, other debt payment costs, and simply that the cost of implementing economic transition in the USA is high. Orthodox economists are trying to point to recent pay increases in the hospital sector.

Ignored is that the private USA hospital system is in crisis and that the average health worker there makes $30,000 a year and health practitioners (including registered nurses and physicians) average $77K a year. Even with necessary wage increases to keep health workers around, it has not caused the price increases.

What has caused the price increases is that underlying price increases for products have driven insurance prices (needed to cover increased costs of stuff, climate disasters, and investment to modernize insurance operations), health products, digital transition, and housing input costs up. This is just already seen prices working their way through the system.

Of course, the market is not driven by the facts. Investors are driven by the belief that inflation is some magical thing that is caused by imbalance in the Force. The only way to stop it is to crush working people so that profits are sustained.

The focus of the government—because they cannot do anything about these cost-based price increases—is on trying to drive the price of oil further down.