April 11, 2023

Hard borrowing

The economy is in slow decline right now.

Some mainstream economists who were concerned over the amount of free money out there during the pandemic (and the previous decade) are now concerned that there isn't enough money out there.

Money supply alone is not a measure we lean heavily on as it depends on the total value being created whether there is too much or too little available.

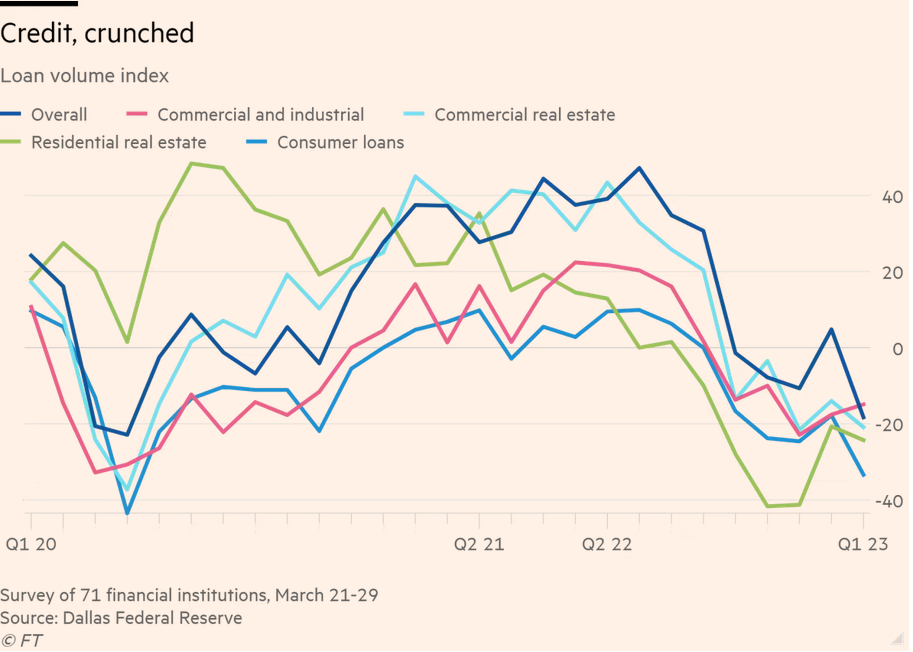

However, banks are noticing some changes in borrowing:

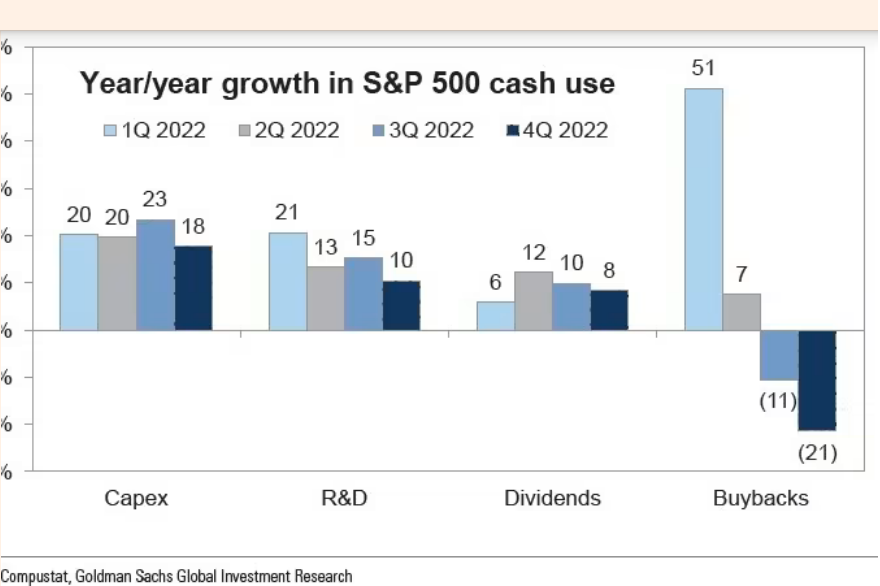

There has also been a small decline in R&D and capital investment. The biggest decline is share buybacks. However, the take-home is that firms do not seem to have as much cash to throw around right now as they did last year.

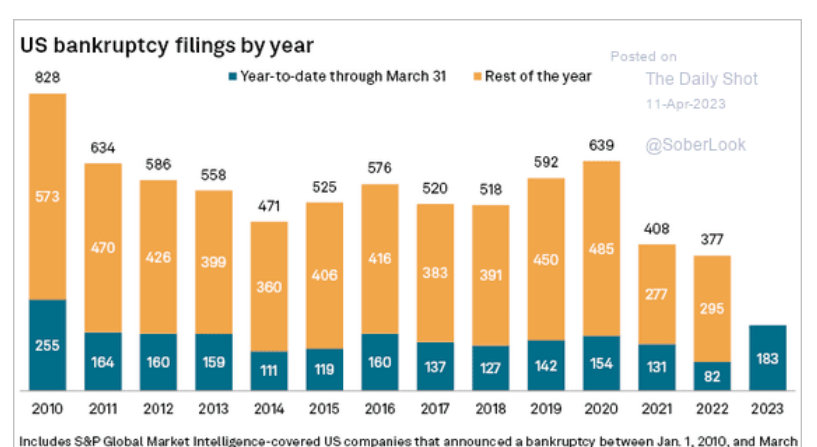

Bankruptcies are up.

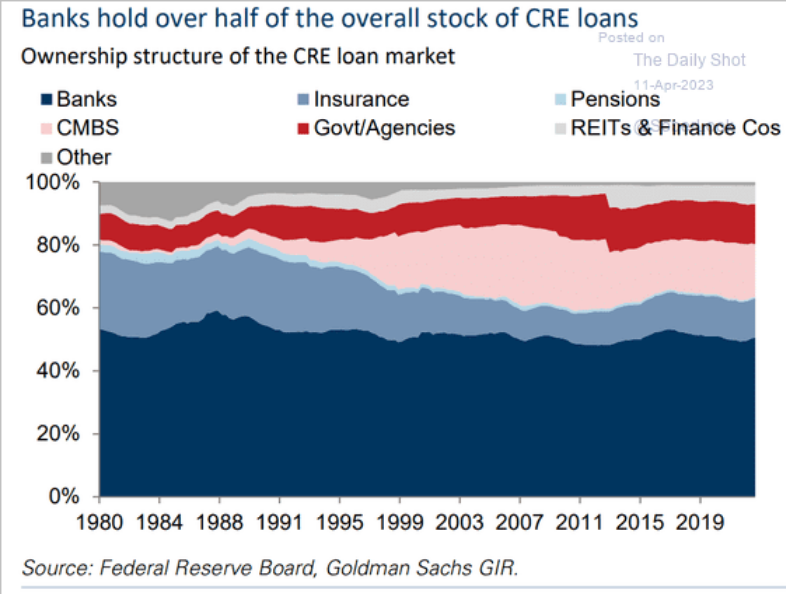

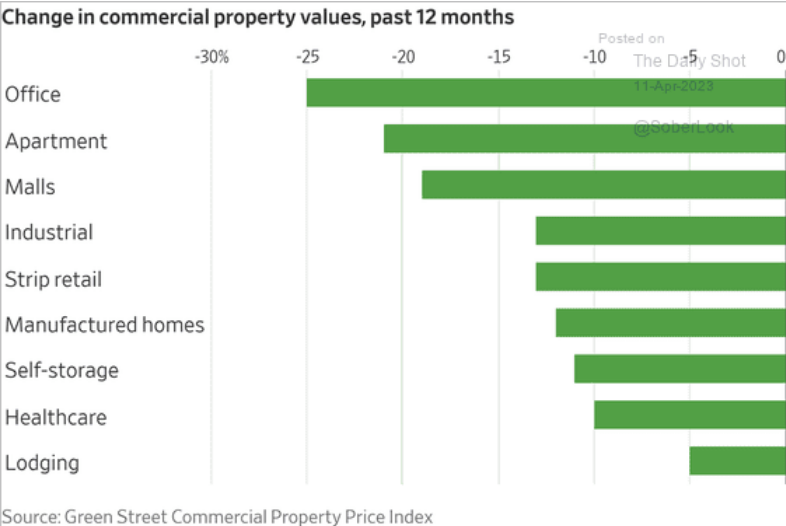

The lack of free money and higher rates is weighing heavily on commercial real estate. That and no one wants to (and are not) going back to the office. The draw-down on commercial leasing is hurting some financial institutions who are heavily invested and cannot seem to get out.

It isn't just offices, but a lot of it is:

For now, it is just increased costs as these companies have held onto their real estate holdings by pumping money from other sources (like lending). But, this is unlikely to continue.

Be warned.

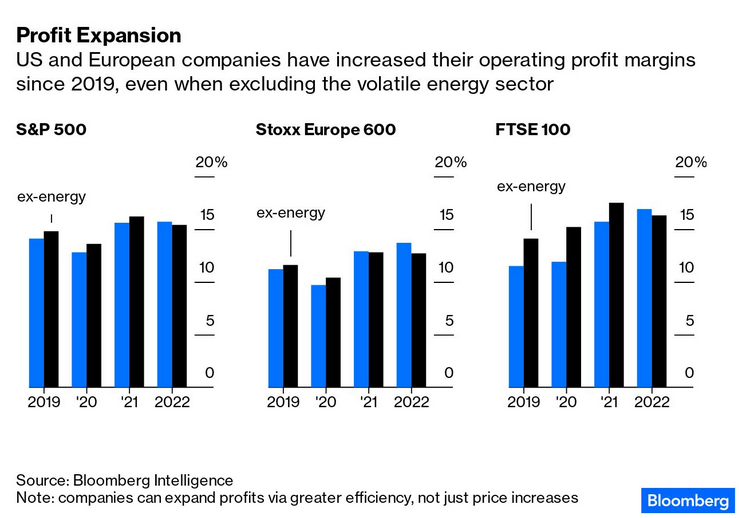

Also, profits were the problem.

Finance is gleeful about the attach on Labour left, but doesn't go far enough.

This lovely headline this morning in the FT from one of their conservative commentators:

There is nothing like pleasing the aristocracy in Britain.

Emerging markets are feeling the rates pinch

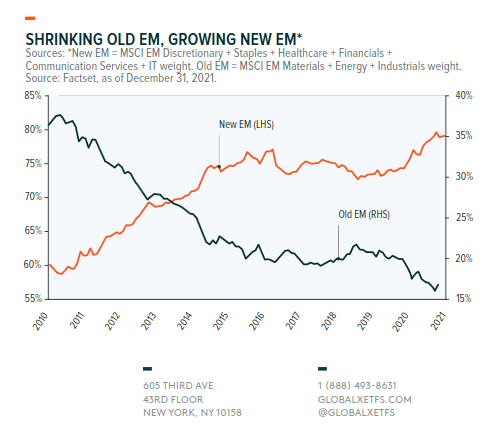

Emerging economies are becoming increasingly worried about the continued high interest rates. Their debt continues to turn over driving up their payments on debts accumulated during the lead-up to and the pandemic.

The cost of ongoing support, a global economic slump we do not seem to be able to (or even are trying to) get out of is racking-up.

A few years ago we were talking about debt forgiveness. That seems to have fallen by the wayside as capital and rich-country governments are eager to receive payments from poorer countries and the misunderstanding of causes of inflation. For sake of the needed investment, it is clear that we need to increase the investment space for developing countries. Otherwise there is not going to be much "developing" going on.

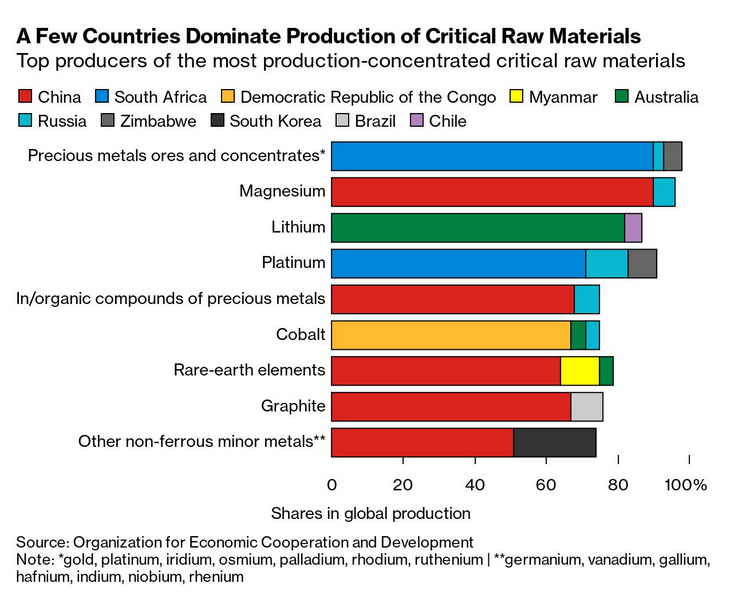

The main focus is mining and resource extraction for direct foreign investment. Changes in investment focus may result in a shift in private investment dollars between countries. A shift in investment of this magnitude is going to make some countries who thought they were going to do well because of historical trends end up on the wrong side of the bill.