April 11, 2022

Recession and Inflation

- Post-Keynesians are full on about wages driving inflation in the US because, as Larry Summers says:

"The labour market is even hotter now than supply-side measures"

- Wage concern is driven by the "tightness" of the employment market.

- Moneterists are all about causing a recession.

-

However, others in industry are not so sure about all this because it looks like the US economy is cooling all on its own:

- shipping of goods has collapsed

- stocks are up

- ports congestion is easing

- oil futures are coming back down

Of course, all of this doesn't mean that there will not be a recession. It just means that the neoclassical economists don't have a clue what is going on.

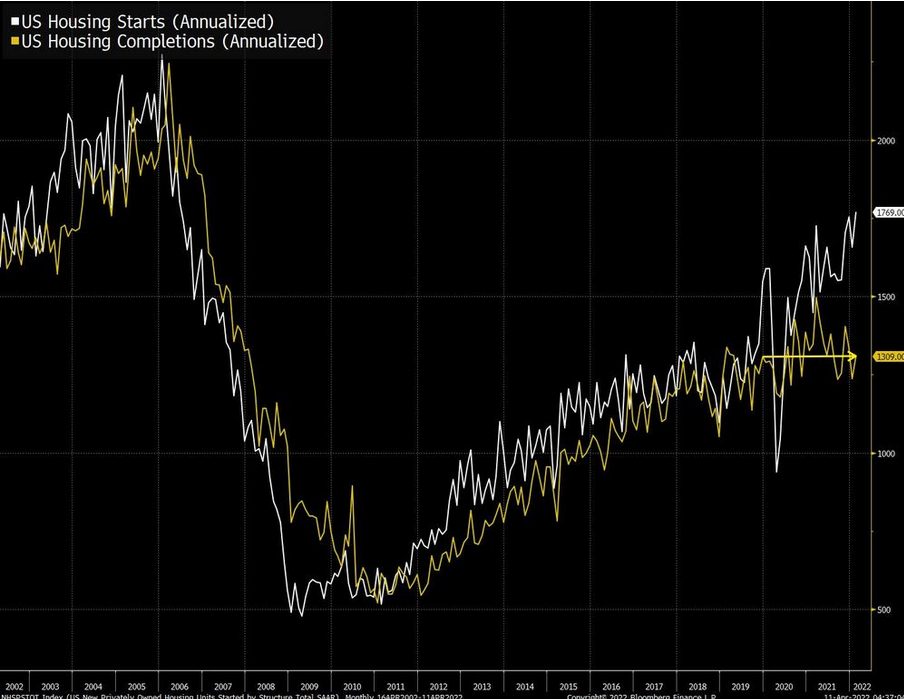

And, the opposite from being confident that there are not supply issues of basic consumer goods in the US, housing shows something else. Houses are not being completed in the US because of lack of supply of both labour and lumber. It is a story that will play out across the economy as China continues its lockdown.

The Marxist analysis points to, well, inflation and recession. But, not because of the tightness of labour or wages of workers. Inflation is there because there is too much "money" in the system and there is no interest in investing it in new production, because there is low profitability and an almost guarantee that there is going to be more expensive credit in the medium term.

Independently, the recession looks like it is on its way because there is low profitability.

Work from home

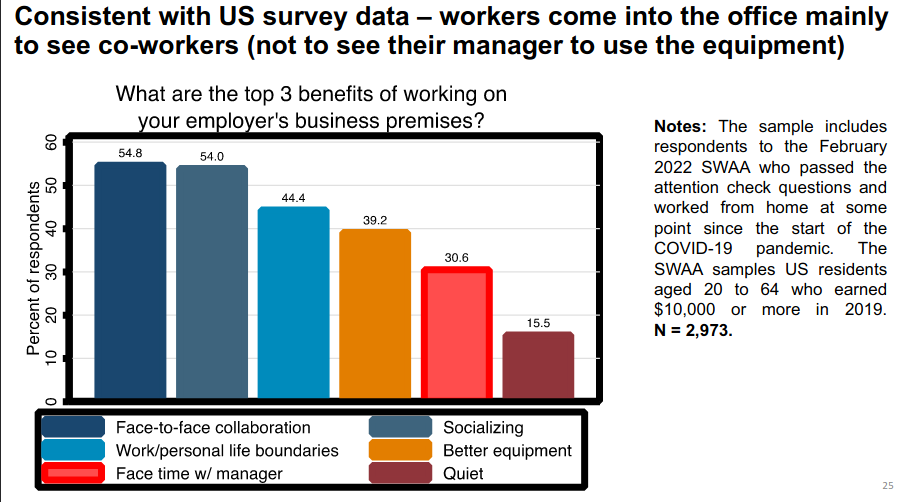

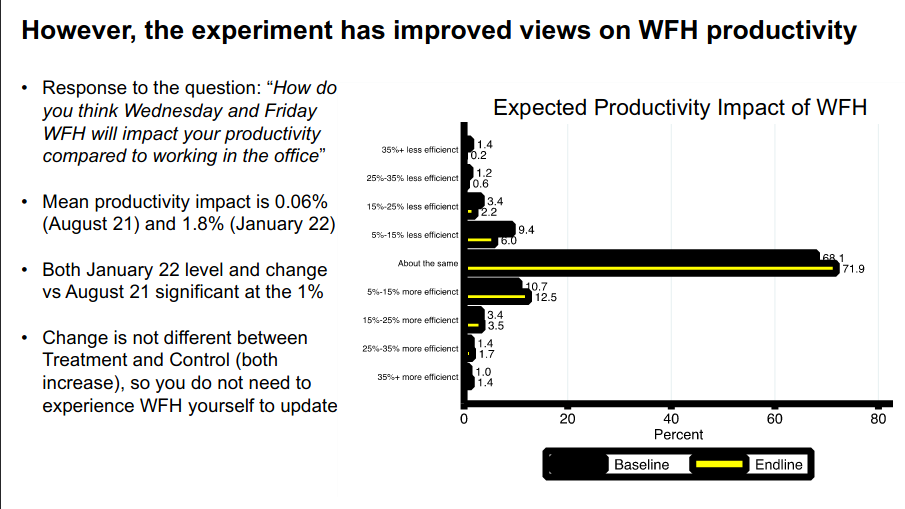

Executive Summary A large multinational randomized 3-2 hybrid WFH vs 5 days per week in the office for 1600 professional graduate employees for six months. They found three results:

- 35% reductions in quit rates and 12% reduction in sick leave

- No impact on performance or promotions

- Employees shifted work from WFH days to evenings and weekends (“flexitime”)

France

- The left does remarkably well with Melenchon getting 20.1%

- Unfortunately, the run-off will be between a horribly outdated view of the world against fascists. Not the best of choices.

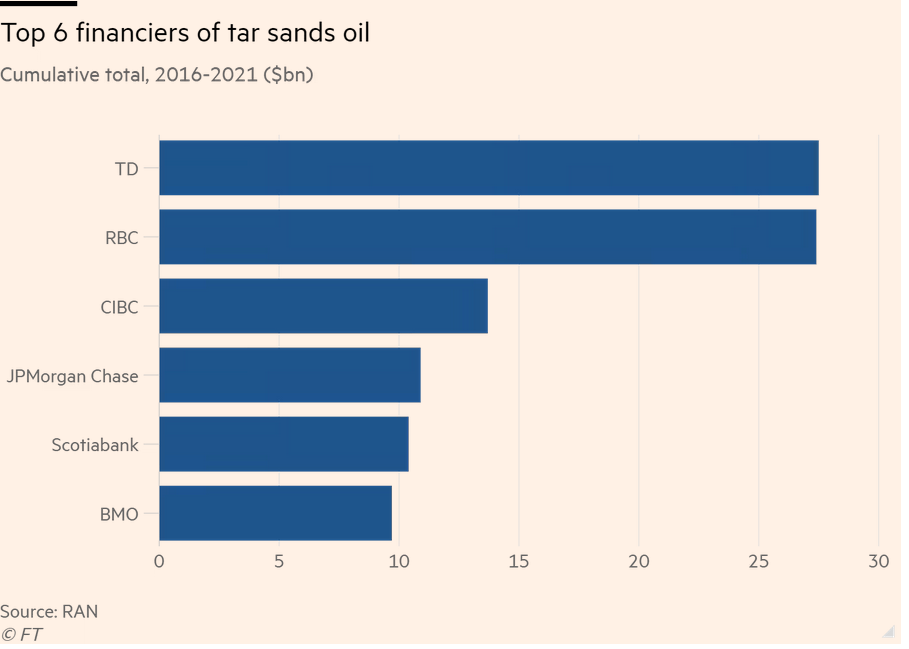

Canada's finance is anti-climate

- Canadian banks double financing of highly polluting oil sands

- Funding comes as financial institutions face growing investor pressure to step up the fight against climate change

- Banks claim these investments are being used to finance transition to greener processes.

Lenders including Royal Bank of Canada, Toronto-Dominion Bank and the Canadian Imperial Bank of Commerce increased their financing to the top 30 tar sands producers and six tar sands pipeline companies by almost $9bn in 2021, according to data from the Rainforest Action Network, the activist group that produces an annual comprehensive report of fossil fuel financing.

Russia is halting bond sales

- It is now in "selective default" according to the S&P.

- Russia will take legal action against the moves that have stopped its money reaching investors.

- Halting bond sales will have less of an effect than the announcement that it is halting bond sales.

- But, the longer-term impacts are unknown.