April 10, 2024

USA Inflation Numbers and Neutral Rates

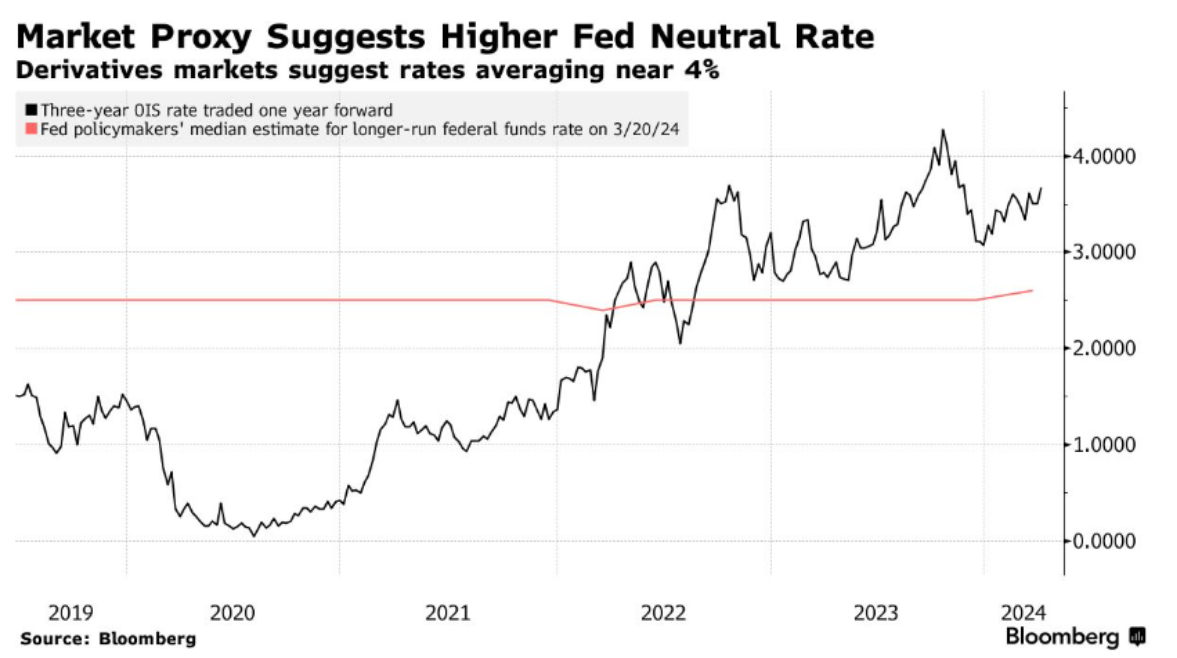

We talked about neutral rates a while ago, but the topic is being brought up again as orthodox neoclassical economists wonder what inflation is doing in the USA and why.

Derivatives pricing suggests traders see the Fed’s neutral rate at well above 3.5%, whereas Fed policymakers’ median estimate is 2.6%. Former Treasury Secretary Lawrence Summers, a paid contributor to Bloomberg TV, sees neutral as more likely being above 4%. (BN)

What does this mean for the economy?

Central bankers are looking at reducing inflation. Essentially, they see a lending rate related to inflation in that it creates an incentive for private banks to lend money. Lower rates, more money is lent because they can make more money lending to private borrowers (to a point).

If a high central bank rate is not dragging the economy into the gutter, but is also high enough to not be "causing" inflation the that is the neutral rate.

The classical view is rather different.

The neutral rate is near the actual costs of private bank business activities. If the central bank rate is lower than the cost of bank operations, it is a profit subsidy to banks creating free money for banks to lend. As central bank rates come close to the true costs of bank operations, banks have to make better choices about who they lend to. Better choices means less (subsidized) speculation and that leads to lower bank profits.

The different stories around inflation continue to be important in explaining what is actually happening in the economy.

On the classical side, we understand the economy to be organized around profit seeking and that this activity results in (sometimes large) fluctuations in economic activity. In this model, investors and business managers orientated towards investors make decisions that are contrary to the needs of workers and the economies these firms operate in.

In the current situation with central bank rates high, consumption low, and no medium term indication things are going to pick up, business managers are doing what they can to extract profit through layoffs and cutting investment—why would they invest if they expect lower profits in the near future?

Under this economic system, the answer is that the state must step-in and provide investment where capital will not. Such a move would not be "inflationary" unless the money is simply spent on profit subsidies—which is what cause inflation in the first place.

It is good to pay attention to the conversation around neutral rates happening in the background of the excitement around what the monthly CPI numbers show. What real neutral rates are will affect investment decisions more than "high vs low" interest rates.

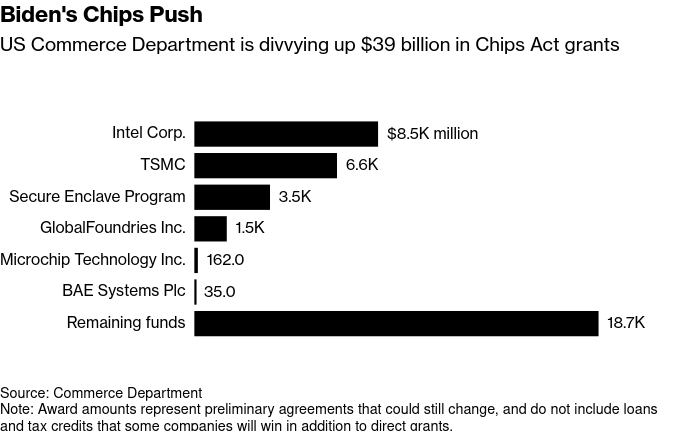

CHIPS Supply

The CHIPS Act in the USA that is subsidizing chip manufactures to move closer to the USA and away from China is working. It is a massive subsidy, so that it not surprising, but it does show a good example of the shift in industrial policy thinking.

Apple is moving iPhone production to India. Bloomberg is reporting that 1/7 iPhones are being made there instead of China.

Arizona has reaped some of the biggest rewards from the Chips Act, with a massive expansion by Intel in addition to dozens of supply-chain initiatives. The TSMC grant includes $50 million in funding to train local workers, and will create 6,000 high-tech manufacturing jobs and more than 20,000 construction jobs, Raimondo said.

These are huge numbers, but the investments are costly and drive production and employment to match.

What is not being explicitly talked about in this context is that the semiconductor battle is part of the economic war with China and really part of the defence spending in the USA.

There are better reasons to invest in semiconductor manufacturing, of course. They are necessary in advanced manufacturing. To reap the benefits of automation and productivity growth, the jobs lost to automation must be made-up locally in building the parts of the robots doing the automation.

This is something the USA policy makers know implicitly and what Canada's policy makers cannot dare to think about. This is a huge problem for Canada's economy.

Coffee

First chocolate and now coffee. At least some of the fair trade programs (and corresponding investment regimes) means that coffee producers may share in this price spike. However, finance capital will likely find a way to divert this speculation-driven profit to themselves.

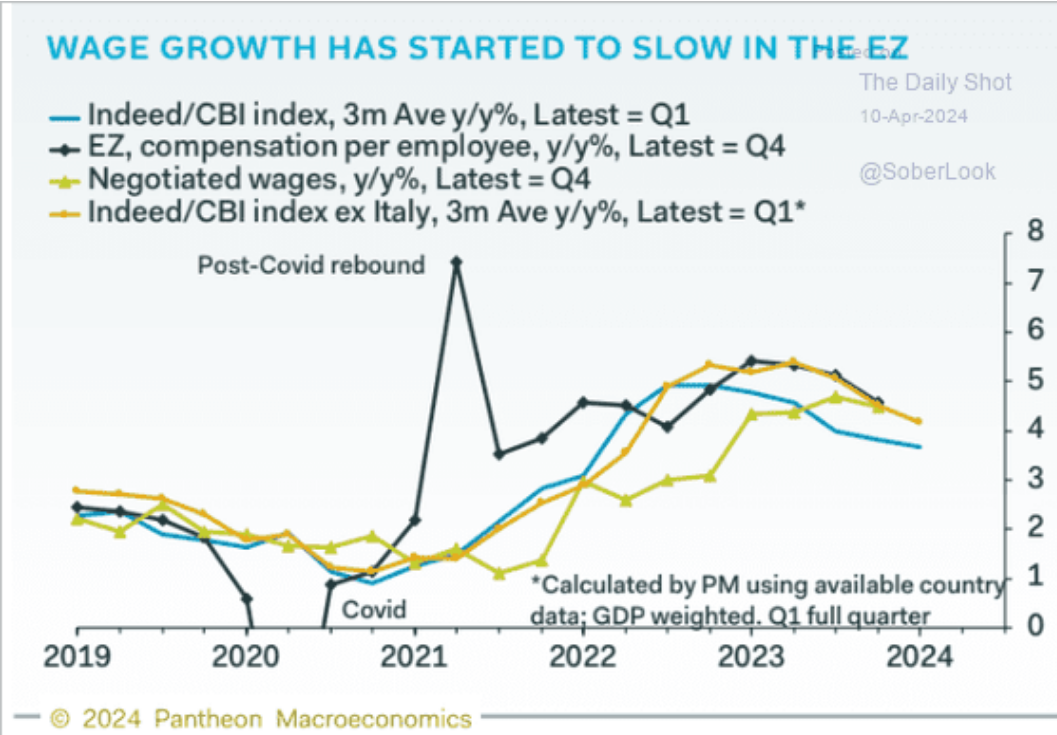

EU Wage Gains

We continue to track wage growth rates as the data is shared. The path down is consistent across the OECD.