April 07, 2022

Canada federal budget today

- Most of the news will focus on "spending" and "debt" (because they are unimaginative).

- Lots of misguided questions about how that spending "will drive inflation" or not (because they are unimaginative and don't know what that word means).

- The real question will be what real public investments will be made and how fast?

- Kevin Paige seems to think that any spending will be slow – because of inflation concerns.

Of course, true inflation is a concern with Liberal budgets because they tend to give money to business in the hope those businesses will drive production. They will not use the money for that (they will simply support their profits), which will drive inflation.

Most of the spending will be some sort of profit subsidy or another – which businesses will take.

There is unlikely investment in new production coming any time soon in Canada:

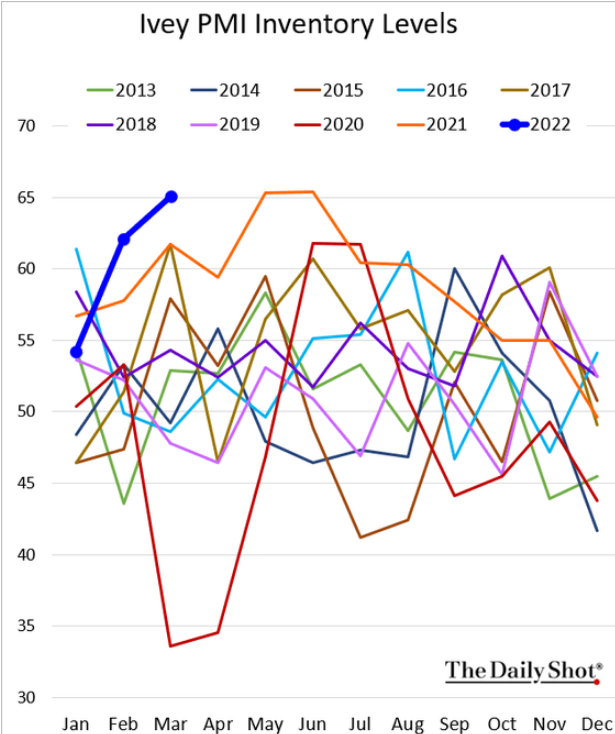

- Inventories are extremely high (companies are preparing for "inflation" of their debt costs)

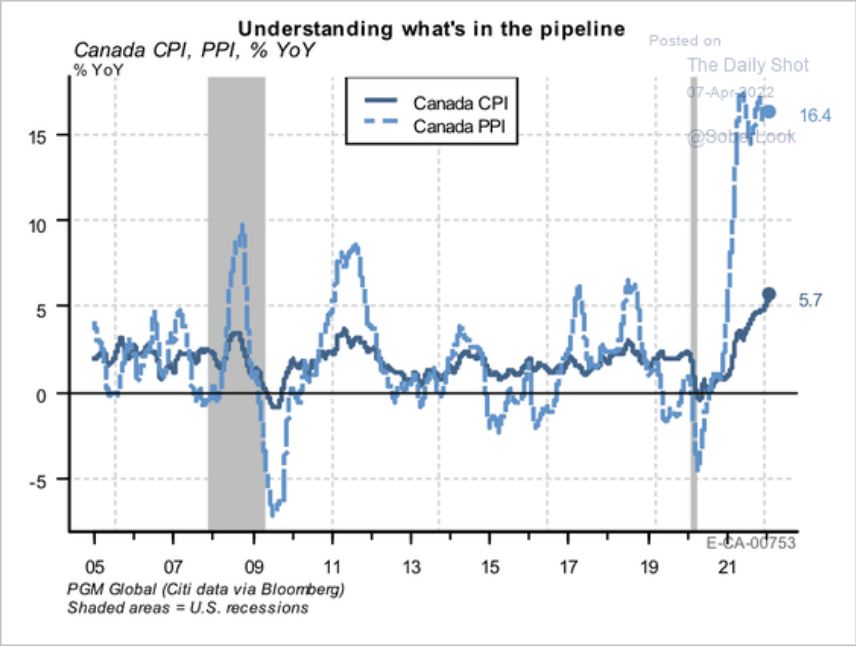

- Price "inflation" is up

- Profits are being squeezed

- Increased likelihood of recession in the US.

- Oh, and real inflation is there.

Watch for Liberal-style privatization and money linked to supporting private businesses.

In PSE, that will mean moves to further directly link research with "small and medium sized companies".

Most foreigners will be banned from buying homes for two years as part of efforts to cool a surging real-estate market. That and other measures, including funds for construction and tax exemptions to help younger buyers with down payments, will feature in today's budget, a person familiar said.

Facebook wants you to pay it for nothing

- Meta lost more than $220bn from its market valuation in February on the day it revealed users were spending increasing time on newer rivals, such as short-form video app TikTok.

- Most of the efforts are in the early stages of being discussed and could change or be dropped, although its plans to integrate non-fungible tokens (NFTs) into its apps are more developed.

- Instagram will soon start to support NFTs.

- Meta has also been exploring more traditional financial services, with a focus on helping to provide small business loans at attractive rates

- virtual currency for the metaverse, which employees internally have dubbed “Zuck Bucks”

The Metaverse is a complex nightmare, not a dream. It will be an advertising land of nothing useful or probably fun. Kind of like Facebook.

And, you will be able to pay "Meta" to be advertised to. Kind of like going to see bad movies.

Liquefied Natural Gas

Here is a bit of background:

- Hydrogen needs are going to come from natural gas: called blue hydrogen.

- Green hydrogen is a red herring as investment in solar and wind energy production to produce green hydrogen (that hydrogen which doesn't result in CO2 released) will not be scaled fast/large enough.

- Blue Hydrogen is not clean fuel, it is just slightly cleaner than transporting natural gas (because of system leakage).

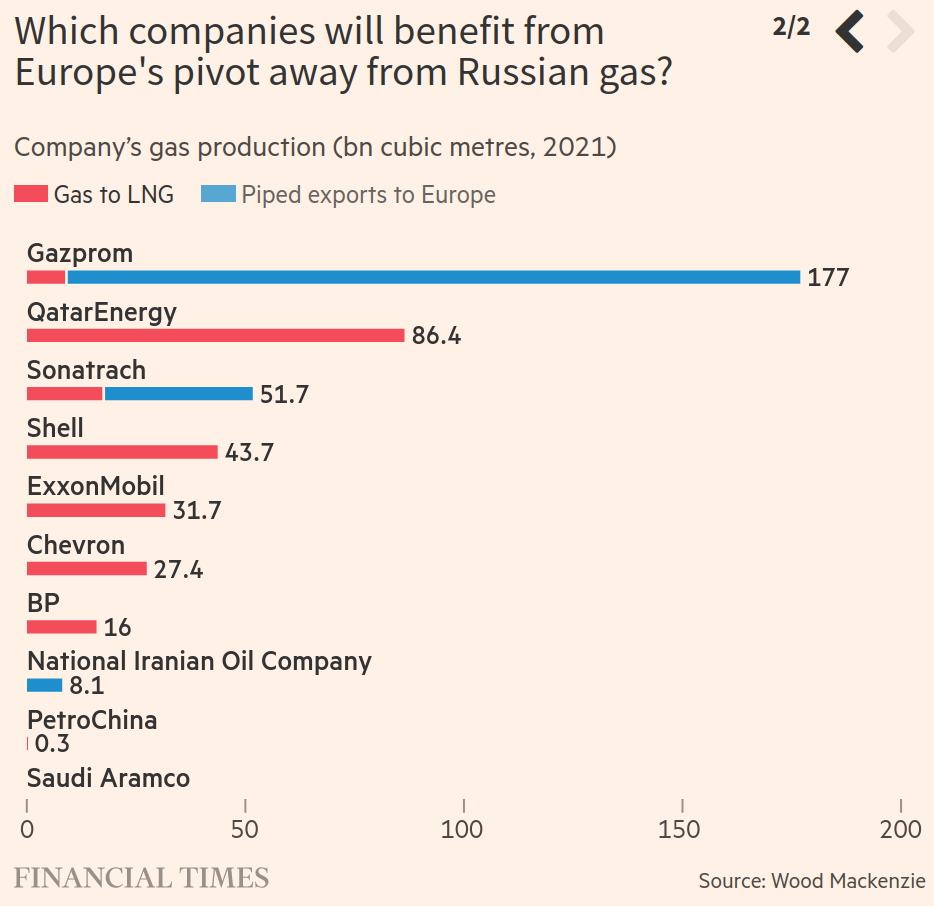

- The move to replace Russian gas with other fuels will drive the production of Blue Hydrogen as an alternative. But, really, it is just non-Russian natural gas companies getting-in on the new market.

- The realty is that there isn't enough gas in the world to replace Russian gas in the medium term.

- Liquefied Natural Gas (LNG) takes additional energy to produce from natural gas as it is supercooled for transport.

Exploiting natural gas deposits is anything but green.

The reason we should care is there is no way to make the transition while relying on the oil and gas companies. The response from these companies is to greenwash in every way they can. Their main greenwashing focus now: Blue Hydrogen

In addition to blue hydrogen, you will read/hear/see more government officials talking about carbon capture and storage attached to these facilities. The amount of money going into these facilities is monstrous ($54B in Australia) and no one talks about the fact that they just do not work. This is money that should be going to scaling-up production of truly green energy production.

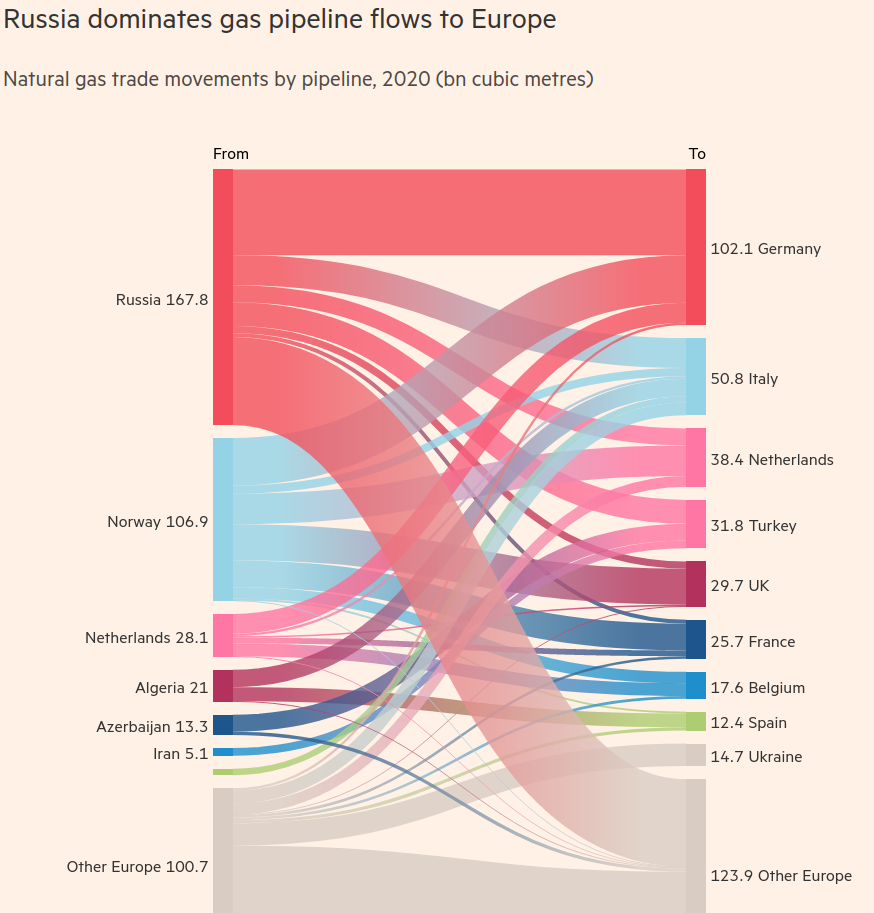

The other issue is that gas is just as geopolitically ridiculous as oil:

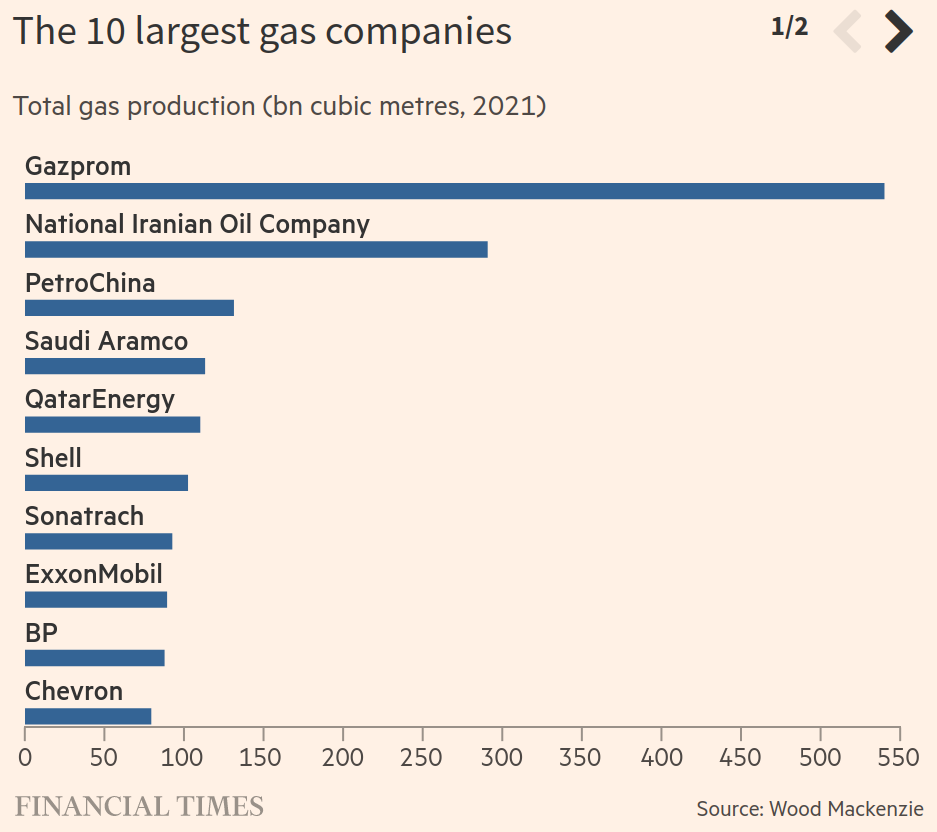

The Iranian national oil company, the largest gas producer after Gazprom, produced 291bn cubic metres in 2021. But 280bn of that was consumed in Iran, according to Wood Mackenzie’s data.

The easing of sanctions on Iran in the event of a nuclear deal could reopen the possibility of broader international access to Iranian gas but would require new export facilities, which would take years to build.

The only suppliers of piped gas to Europe are Norway, Azerbaijan, Libya and Algeria, where state-owned Sonatrach sent 34bn cubic metres via pipelines to Spain and Italy last year.

State-owned QatarEnergy produced 110bn cubic metres of gas last year, of which 24bn were consumed in Qatar and 86bn converted to LNG for export.

War will continue to haunt these regions if alternatives are not invested in.

- Final note on Russia: it found buyers for all of its Sokol crude (its main export grade oil) for May – at a discount. So much for war leading to less burning of oil.

Shanghai lockdown

- China continues to monitor a spike in cases through lockdowns

- 20,000 people per day in Shanghai are being infected – the majority are asymptomatic.

- Impacts on supply chains are different from last time (stuff just doesn't get to the ports, as opposed to sitting on ships), but could be just as intense as last time.

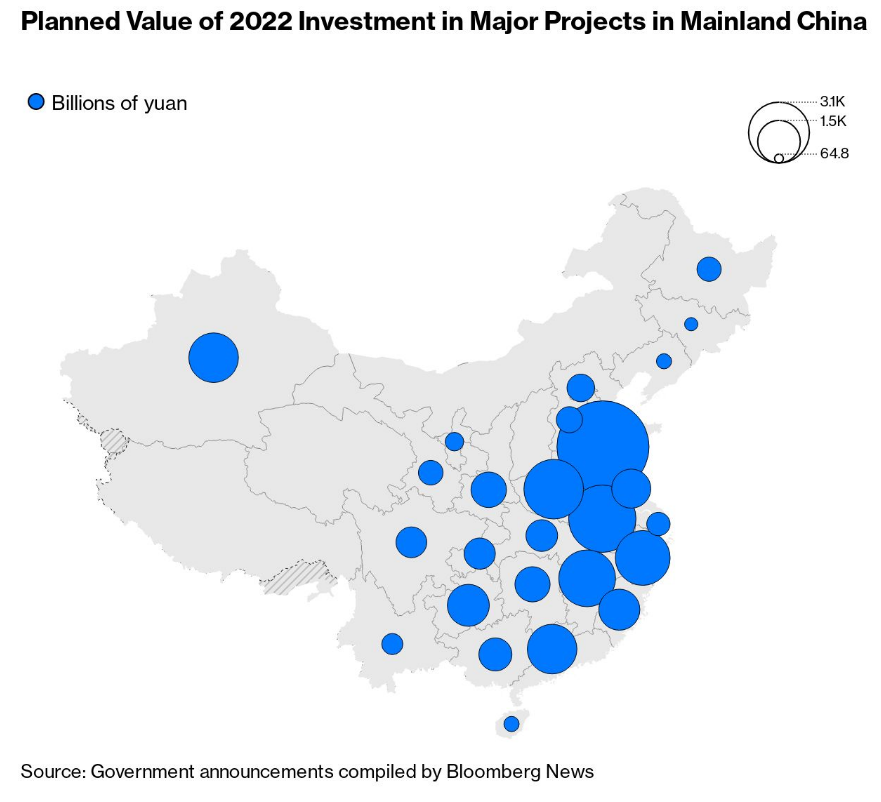

This has not stopped the Chinese government from planning a spending program for productive employment:

- Planned investment this year amounts to at least 14.8 trillion yuan ($2.3 trillion), according to a Bloomberg analysis. That’s more than double the new spending in the infrastructure package the U.S. Congress approved last year, which totals $1.1 trillion spread over five years.